what is the salt deduction repeal

The SALT deduction allows states the fiscal room to spend. Treasury 887 billion in lost revenue for 2021 alone according to the Joint Committee.

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

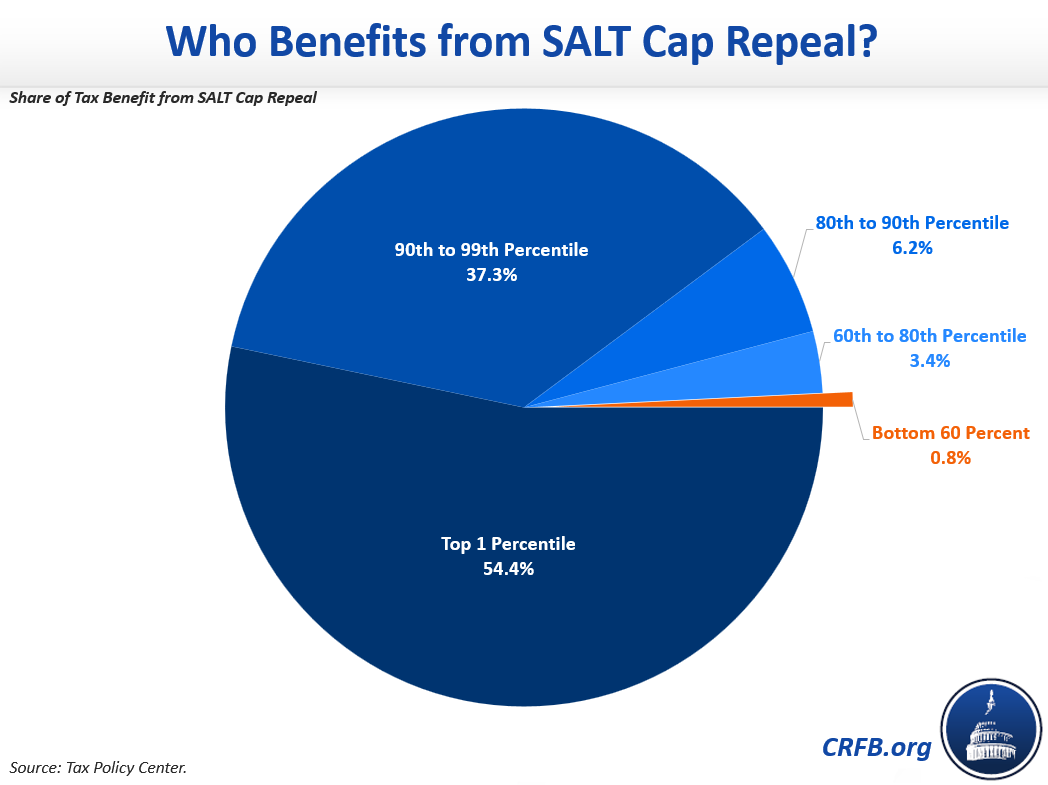

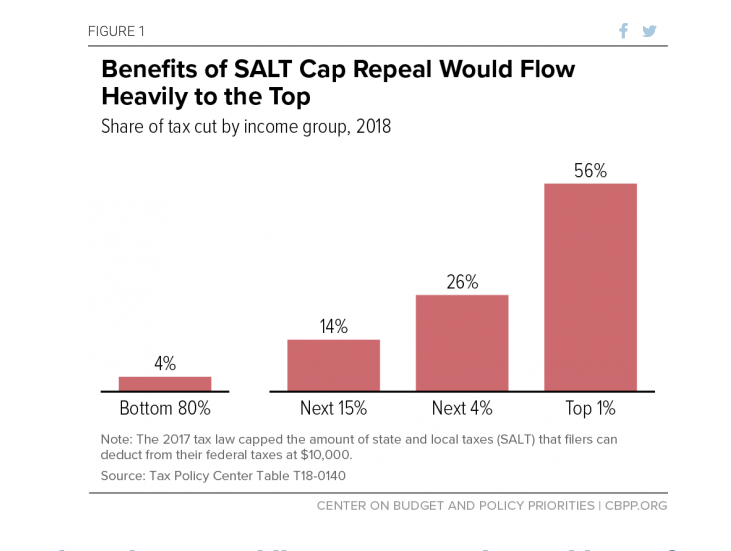

Under a full repeal the top 1 percent of households would receive an average tax cut of at least 35000 compared to a paltry 37 for their middle class counterparts.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

. The SALT deduction allows states and localities to give their high income earners a discount on their taxes. What would repealing the cap cost. The SALT deduction when no cap is in place is a highly regressive tax policy meaning its benefits go to the wealthiest taxpayers who regularly write off over 10000 on.

It is currently set to expire at the end. A new bill seeks to repeal the 10000 cap on state and local tax deductions. 27 2021 Report The Long Island congressman says the limits on deductions for state and local taxes.

It should be eliminated not expanded Series. Without SALT there would be a race to the bottom in terms of state tax rates and a decline in state. The so-called SALT deduction cap which is poised to sunset in 2026 limits the amount of state and local taxes that Americans can deduct from their federal taxes to 10000.

54 rows Some lawmakers have expressed interest in repealing the SALT cap which was originally imposed as. Middle Class Memos Up Front The SALT tax deduction is a handout to the. The cap on the SALT deduction was created by Republicans 2017 tax cut law as a way to help pay for other tax provisions in that measure.

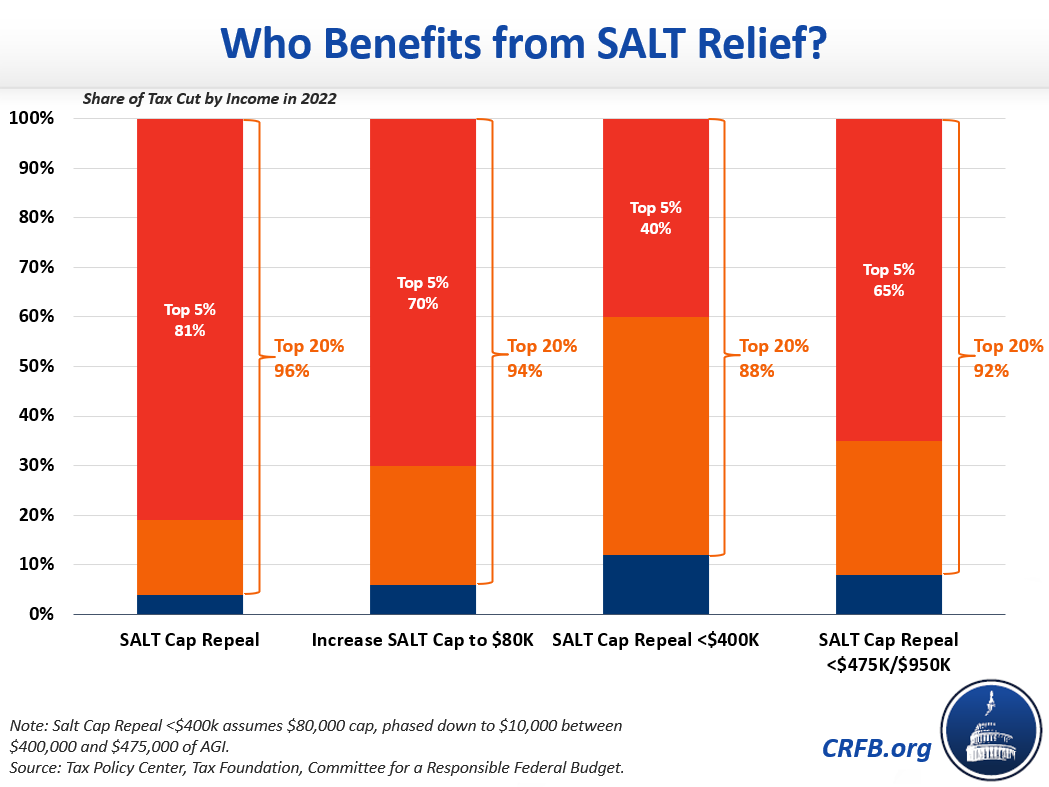

House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before reinstating the 10000 limit in 2031. The SALT tax deduction is a handout to the rich. Both the House and Senate tax reform bills eliminate.

For income taxes the deduction keeps income from being taxed twice once at the state level and again at the federal level. A group of moderate lawmakers are pushing to repeal the so-called SALT deduction cap in the reconciliation package saying no SALT no deal but other Democrats are. 11 rows As President Bidens tax plans are considered in Congress the future of the 10000 cap for state.

Democrats from high-tax blue states are insisting on the repeal of a rule that limits state and local tax SALT deductions to 10000 which was enacted as part of the 2017 tax. The change may be significant for filers who itemize deductions in. According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year.

Late last month The Hill reported that Senate. Suozzi says SALT tax relief has to be part of budget deal Sept. The early repeal of the NOL suspension and business credit limits comes amid strong tax revenues and a 457 billion budget surplus.

Preserving the deduction cap or better yet a full repeal of the SALT. Democrats tried repeatedly to secure a large tax break for the wealthy but it appears their efforts wont be successful. According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or lessThis.

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. House Democrats spending package raises the SALT deduction limit to 80000 through 2030. The acronym SALT stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to taxpayers who itemize.

Restoring the full SALT deduction would cost the US. What is the SALT cap repeal. 52 rows The state and local tax deduction commonly called the SALT deduction is a federal.

Expansion of SALT Cap Workaround SB.

Salt Deduction Resources Committee For A Responsible Federal Budget

State And Local Tax Salt Deduction Salt Deduction Taxedu

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Eliminating The Salt Cap To Help The Rich Doesn T Fight Coronavirus Ways And Means Republicans

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Why Repealing The State And Local Tax Deduction Is So Hard

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget